Wary of persistent core inflation — despite a drop in headline CPI and central bank easing in the US — the RBA kept the official cash rate at 4.35% during its September meeting.

It was the seventh consecutive hold, but RBA Governor Michelle Bullock said a rate rise was not considered.

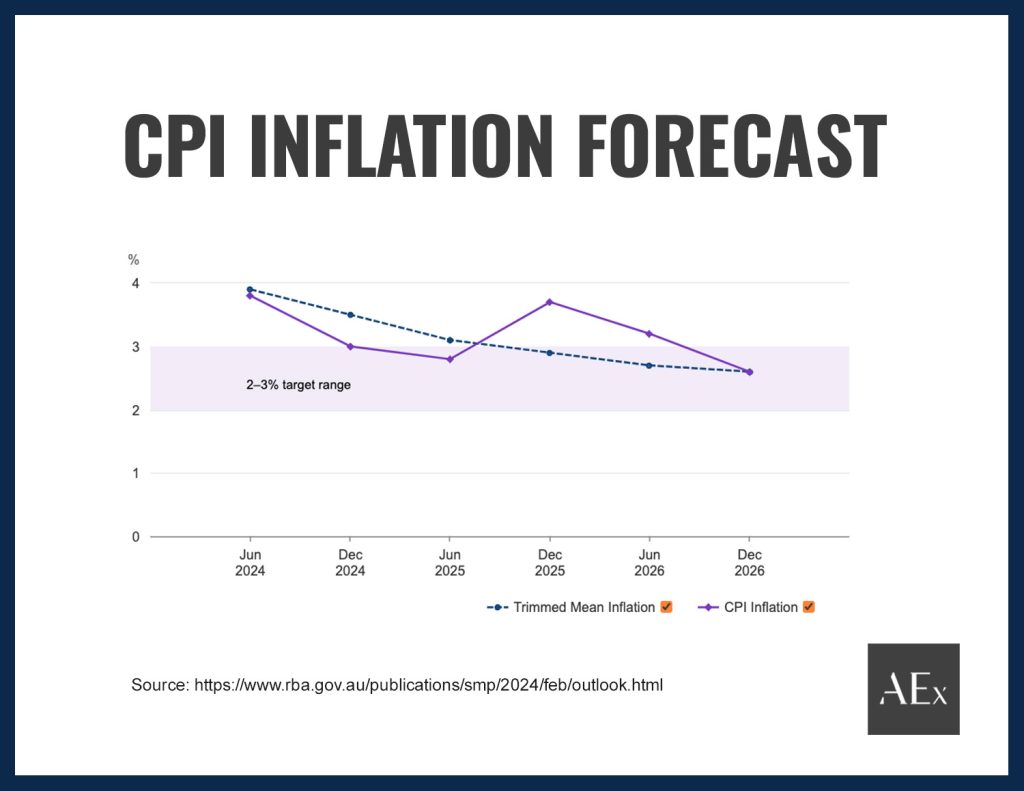

A discouraging inflation print for the March 2024 quarter and a shocking 4.0% rise in May’s monthly CPI data may have delayed monetary easing, with RBA Governor Michelle Bullock highlighting in June how the “pace of decline has slowed”, meaning the path to the 2-3% target was “unlikely to be smooth”.

August’s monthly CPI numbers were a relief — headline inflation rose only 2.7%, within the target band. But the RBA noted:

Most of Australia’s major banks now think the RBA won’t start cutting interest rates until 2025.

A number of other economists think a rate rise before the end of 2024 is necessary, if not likely.

| Key Takeaways: |

|---|

| The RBA’s stance has turned hawkish but it’s in no hurry to cut rates until data is clear on inflation easing. |

| Only one major bank is still forecasting cuts starting in 2024, with the rest predicting the first 0.25% cut in Q1 2025. |

| Annual headline inflation is at 3.8%, with August’s monthly indicator at 2.7% — down from 3.5% the previous month. |

| GDP growth remains flat, but the labour market is showing signs of loosening. |

Higher-For-Longer Reality, But Will 2025 Bring Deep Cuts?

In October, NAB changed its forecast to indicate the Reserve Bank of Australia (RBA) would begin cutting interest rates by 25 basis points in February 2025.

That matches predictions from ANZ and Westpac.

Commonwealth Bank remains an outlier among the ‘big four’ — it’s still forecasting a 0.25% cut this calendar year, in December.

Commbank head of Australia economics, Gareth Aird, said on 14th October that a host of monthly prices and consumer demand data indicates disinflation is gaining steam.

However, he acknowledged that quarterly CPI data due on 31st October will be critical:

NAB’s Gareth Spence told The Australian the RBA would not be in position to move in Q4 2024, with indicators suggesting an imbalance in supply and demand and the upcoming Q3 CPI print impacted by subsidy effects:

Economist predictions have been to-ing and fro-ing a bit since mid-year.

A higher-than-expected monthly CPI indicator figure for May shook up the market and pushed back rate cut expectations to Q4 2024, and increased calls for rate hikes by some.

Then, RBA Governor Michele Bullock revealed after the RBA’s decision to hold in August that the Board had seriously considered a hike and that “a rate cut is not on the agenda in the near term”, which she clarified as the next six months.

The RBA’s Statement on Monetary Policy outlook published in August also revealed a slower timeline for trimmed mean inflation to abate.

Above: the RBA is prepared to pump brakes on rate cuts to ensure the inflation falls into the 2%-3% target range.

Subsequently, many banks and economists further pushed their forecasts for the start of rate cutting out to the first or second quarter of 2025.

In August NAB was predicting easing by May 2025, but is now more optimistic.

Although the RBA held the official cash rate again in September and kept up its hawkish tone — amid the backdrop of August’s CPI decline and global easing of monetary policy — there’s a renewed sense that the only way is down.

- Interest rates on fixed loans have been reduced by a growing number of banks and other lenders in October, by an average of 0.3% in anticipation of cuts next year.

- An October sentiment scan found consumers are no longer fearful that the RBA will raise rates. Over half now expect mortgage rates to be unchanged or lower over the year ahead.

Independent economist Saul Eslake told NewsWire that when the RBA does cut (he thinks in February), it might be a larger 50 basis point reduction:

Government Spending In Spotlight As Weak Growth Persists.

The 2024 Federal Budget delivered on Tuesday, 14 May, has raised concerns for the RBA.

RBA Governor Bullock said in June: “Recent budget outcomes may also have an impact on demand, although federal and state energy rebates will temporarily reduce headline inflation.”

The budget added billions in extra spending — injecting more cash into people's pockets and the broader economy.

Important!

It also introduced a $300 credit to Aussies’ electricity bills throughout 2024-25, which is expected to shave some percentage points off the CPI.

Treasurer Jim Chalmers has said government policies have helped moderate inflation since the peaks of 2022 and expected that to continue as budgeted cost-of-living relief measures that kicked in from July took effect.

He said in September — ahead of weak GDP figures of just 0.2% growth in the June quarter — that the rate rises that are already in the system were “smashing the economy.”

In deciding to hold rates at 4.25% in September, the RBA noted that household consumption had been weaker than expected.

Westpac chief economist Luci Ellis pointed out that much of the decline in headline inflation (which fell to 2.7% in August) “reflects temporary measures such as the electricity rebates and other cost-of-living measures, this is not enough to keep inflation in target.”

After unemployment remained steady at 4.1% in September, Judo Bank economist Warren Hogan said it highlighted that the cash rate may need to increase in November to deal with inflation.

“…most of us economists think full employment is an unemployment rate around 4.5 per cent, we don’t know, but the reality is that this fear of higher unemployment is not coming through,” Hogan said.

Prominent forecasts for the central bank’s cash rate include:

| Q4 2024 | Q2 2025 | Q4 2025 | |

|---|---|---|---|

| Westpac | 4.35 | 3.85 | 3.35 |

| NAB | 4.35 | 3.85 | 3.35 |

| ING | 4.35 | 3.85 | 3.35 |

| CBA | 4.10 | 3.60 | 3.10 |

The RBA Continues To Be Vague On Rate Cuts.

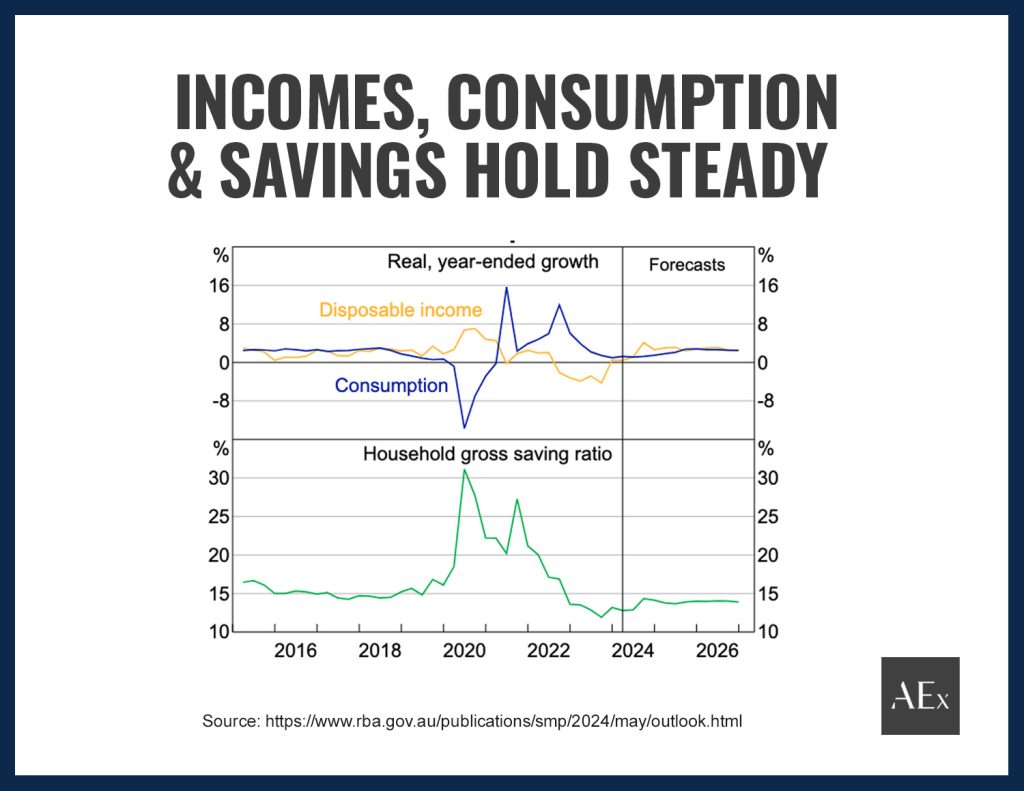

The RBA expected consumption to strengthen in the September and December quarters in line with a recovery in real incomes and extra spending money from the government’s Stage 3 tax cuts.

Of course, a lot depends on output growth, how quickly employment conditions loosen, and how companies respond to weak economic growth in terms of pricing decisions and wages.

The Board's language about the likelihood of further rate hikes is vague. It depends on future economic data and how risks evolve.

(Related: Will Australia Go Into A Recession In 2024?)

What Is The RBA's Next Move?

Based on market-determined prices in the ‘ASX 30 Day Interbank Cash Rate Futures’, the ASX publishes an RBA Rate Indicator that calculates the percentage probability of a change in the cash rate.

As of 18th October 2024, trading of cash rate futures contracts indicated a 10% expectation of an interest rate decrease to 4.10% at the next Reserve Bank board meeting (that is, a 90% expectation of no change).

(Related: Why Is Living In Australia So Expensive?)

Key Economic Indicators Influencing Australia’s Cash Rate.

What does the current economic data tell us about how interest rates might track?

1. CPI Inflation.

Keeping inflation in the 2-3% range is the RBA’s primary goal.

Did You Know?

Cash rate increases are designed to stifle inflation by making spending less attractive and, therefore, reducing the demand that leads to higher prices. However, it’s a careful balancing act to do so without depressing the economy.

The most current data from the ABS shows that:

- Annual CPI inflation is 3.8% (% change from June 2023 to June 2024).

- CPI inflation decreased from a 4.1% in the December 2023 quarter, and a 3.6% increase in the March 2024 quarter.

- The monthly indicator data for May was a surprising 4.0%, but has been in decline since and was just 2.7% in August.

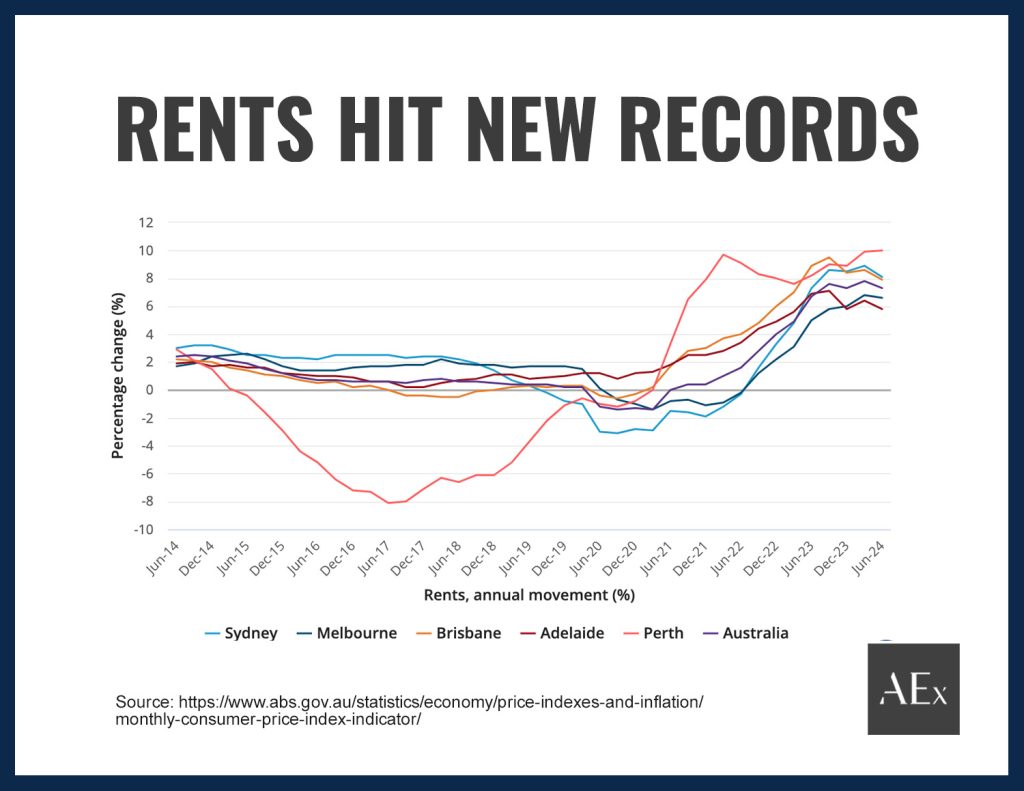

Pockets of high inflation persist, especially for housing, rents, insurance, education, and health, which all rose in the 12 months to June 2024.

Rents and electricity would have seen even higher increases if it weren’t for government assistance measures.

Did You Know?

The ABS says without Energy Bill Relief Fund rebates, electricity prices would have increased by 14.6% since June 2023.

Above: Australian rent prices are cooling everywhere except in Perth, after rising 7.3% over the 12 months to June quarter.

Insurance premiums saw the largest ever annual price increase in 23 years in the March quarter, and continued to record strong growth in Q2, increasing by 14% year-over-year.

Important!

Much has been made of monthly inflation figures (like May's shock increase and August's decline into target territory), but it is an ‘indicator’ representing around 70% of the regular CPI basket.

Plus, inflation tends to lag other economic indicators, so it will take time to understand the flow-on effects of higher rates.

The next important gauge in 2024 will be the September 2024 quarter CPI figures, which the ABS will release on 31st October. Many forecasts put headline inflation below 3%.

2. GDP Growth.

Recent National Accounts data from the ABS shows:

- Weak national Gross Domestic Product (GDP) growth.

- A slowdown in household discretionary spending.

- A rise in government spending, driven by social benefits.

- A fall in both private and public investment.

National income data (seasonally adjusted) for the June 2024 quarter:

- GDP change of 0.2% for an annual increase of 1.0% down from 1.1 in the March quarter.

- GDP per capita of -1.5% annually, compared to -1.3 in the March quarter.

Katherine Keenan, ABS head of national accounts, said that household spending and total investment fell, while government spending rose.

Important!

On the household front, spending on many discretionary categories fell — especially air travel — and the household saving ratio was just 0.6%. Disposable income did rise, driven by a rise in compensation of employees.

The Reserve Bank expects a rise in household wealth in the remainder of 2024 to improve economic growth.

In fiscal policy, the Australian Government has made several budget cuts to help ease inflationary pressure, revealed in its Mid-Year Economic and Fiscal Outlook 2023-24 (MYEFO).

But its budget delivered in May 2024 was widely regarded as inflationary by adding up to $20 billion in spending in 2024-25 and 2025-26.

3. Unemployment.

Higher interest rates put upward pressure on unemployment. As the price of money increases, the cost of borrowing hurts companies’ bottom lines.

While the number of employed Aussies is currently high, more people are working fewer hours and participation has lifted — possibly due to people returning to work by necessity to cover rising living costs.

Seasonally adjusted ABS labour force figures from September 2024 show:

- Australia’s unemployment rate is 4.1% (unchanged from August).

- The underemployment rate decreased to 6.3%.

- The participation rate is 67.2% — a new record high”.

A loosening labour market wouldn’t normally support further tightening of Australia’s interest rate. But as Bjorn Jarvis from the ABS explains, the latest job figures show “there are still large numbers of people entering the labour force and finding work.”

The RBA forecasts that growth in real incomes (salaries adjusted for inflation) will recover strongly in the second half of 2024.

Above: Real income growth is expected to lift in the second half of 2024.

4. Consumer Sentiment.

A major contributor to the nation’s economic growth is how everyday Australians spend their money.

Economists are keen to understand whether people feel financially flush and ready to buy, as a guide to likely reductions, or growth, in consumption.

Important!

Consumer sentiment was low throughout 2023 and remains low in 2024, but is starting to become more hopeful.

Here’s what Australia’s two key consumer sentiment surveys indicate currently:

- The ANZ-Roy Morgan Consumer Confidence Index was a weak 83.4 as of 15th October 2024 — that’s a record 89 straight weeks below the 85 mark.

Around a third of respondents expect ‘bad times’ for the Australian economy, with just 10% expecting ‘good times’ ahead.

- The Westpac-Melbourne Institute Index of Consumer Sentiment was up to 89.8 in October 2024, which is a two and a half year high. It’s far below the long-run average of 100.8.

Important!

The survey found consumers' expectations had been buoyed by interest rate cuts abroad and more promising signs that inflation is moderating locally.

5. Global Economy.

How other major economies are faring influences Australia’s trade: the cost of our imports, the value of our exports, and the purchasing power of the AUD for ordinary people.

Global growth is expected to stabilise over the next year as nations emerge from a high-inflation environment and confidence improves.

Important!

China’s flagging property market is a key risk for our economy, given that China is our largest trading partner.

The World Economic Forum’s Chief Economists Outlook report finds:

- 54% of chief economists expect the condition of the global economy to remain unchanged over the next year

- 37% of leading economists from across industries and international organisations expect it to weaken.

The general buoyancy of countries like the US and the UK also provides forewarning of global economic conditions that can buffet Australia.

A higher-than-expected US unemployment number in July contributed to the Federal Reserve’s decision to finally cut its cash rate by 0.50% at its September meeting.

A soft landing for the US is still within grasp, but recent data paints a complicated picture:

- Jobs data looked strong in September at 4.1% unemployment and an increase of 254,000 jobs. But initial jobless claims saw a spike in October, increasing by 33,000, which was the highest level since August 2023.

- The US inflation print for September showed stubborn inflation, with another 0.2 increase (following 0.2% increases in both July and August). While annual headline inflation is 2.4%, the ‘core’ inflation gauge rose 3.3%.

Financial markets are pricing in further rate cuts by the Fed at its two remaining meetings in 2024.

In the UK, the official policy rate was reduced in August after inflation fell to within the 2% target in the 12 months to June 2024.

It’s the first time the rate of price increases in the UK has dropped below 2% since 2021.

Frustration about Australia’s central bank not following the lead of other countries belies the fact that the US and the UK pushed rates higher than Australia in 2023 to curb inflation.

Entrepreneur and managing director of Yellow Brick Road Home Loans Mark Bouris said in October that it’s not surprising we’re lagging:

He also said it was a myth that domestic interest rates were harsher than in the US, as our ‘real’ interest rate — the cash rate adjusted for inflation — was actually lower.

Rate cutting in the US and the UK would make the greenback and pound less attractive to investors, which could boost the strength of the Australian dollar on the Forex market. The Aussie saw a nine-month high in the immediate wake of the RBA’s September meeting.

Appreciation of the AUD should reduce the price of imports and further slow inflation domestically.

Final Words On The Interest Rate Outlook For 2024.

How rates move in 2024 will depend on whether the RBA’s tightening cycle has done its job.

Has the inflation beast been slain, or will consumer demand, global turmoil and commodity prices continue to destabilise economies and push prices higher? Only time will tell.

Jody

Nelson says:

I attempted to use the “hack” to dodge conversion fees, but sadly after converting AUD to USD on a Wise account, there doesn’t seem to be a way to deposit that money into eToro; i.e. eToro recently disabled Wire transfers and Wise doesn’t support SWIFT transfers for sending USD to a bank in the US?

John Keys says:

CMC Invest are an abysmal in turning around new accounts.

Over 1 month to setup up an account with an investment trust, and still waiting. I was promised 5 business days.

Reg Watson says:

Given that China’s economy is going down the toilet how the heck do we expect an appreciation of the Aussie in 2024 ? We are tied to China.

Regular citizen says:

Unless you can see into the future or time travel, try to refrain from predicting a stronger AUD. It’s now Dec 2025 and contrary to all you top earning ‘economists ‘, the AUD ain’t shit.