What’s the #1 finance myth that trips up small business owners? That profits increase as you rake in more revenue. Unfortunately, the opposite is often true.

Your income statement helps you see warning signs – before they snowball into unmanageable issues.

It reveals how well you’re managing expenses alongside the revenue you’re generating.

Are you turning over a lot of money – but not keeping much? Your income statement will give you a brutal reality check.

It’s one of the first places you must look if you want to effectively analyse your SMB’s business model, as well as your resourcing, pricing, sales and marketing strategies.

(Related: How To Calculate Your Return On Equity).

What Is An Income Statement?

An income statement is a useful financial report that shows your business’ profits and losses over a period of time.

Your expenses over a specific timeframe, typically a year, are subtracted from all your sources of revenue over the same period, across both operating and non-operating activities.

An income statement lists:

- Revenues and income, including money from your clients or customers earned through sales or service delivery (or both) and any other fees or commissions you charge. Income can also include interest earned, rental income, investment income, and royalty payments.

- Expenses and losses, including the costs of buying, producing or delivering the product/service you offer, day-to-day admin and marketing spend, overheads like power or business insurance, the cost of asset depreciation, and investment in research and development (R&D).

Your P&L statement will also usually provide a calculation of:

- Gross profit: Your total income minus the specific cost of goods sold (COGS) or ‘cost of revenue’, such as wholesale prices you paid for products/items as well as costs related to the labour, manufacturing overheads and materials used in the creation/delivery of goods/services.

- Operating income (aka EBIT): Your total income minus COGS and operational expenditure. This metric helps you gauge your overall profitability before any interest or taxes are factored in. If gross profit is high, but operating income is weak, you’ve got a starting point for cutting costs.

- Net profit/income: This is where the term ‘the bottom line’ comes from: net profit is the final value on your income statement, reflecting profits after all operating and non-operating expenses and income taxes are removed.

Other specific line items you might see in a typical small business income statement include:

- Marketing and promotion costs.

- Admin costs.

- EBITDA (Earnings before Interest, Tax, Depreciation, and Amortisation).

- Depreciation expenses related to major asset purchases.

If you’re using accounting software for SMBs, it’s also common for your income statement to include profit margin calculations.

We’ve also broken down how to calculate profit margins and what they mean.

How To Read An Income Statement (Real-Life Example).

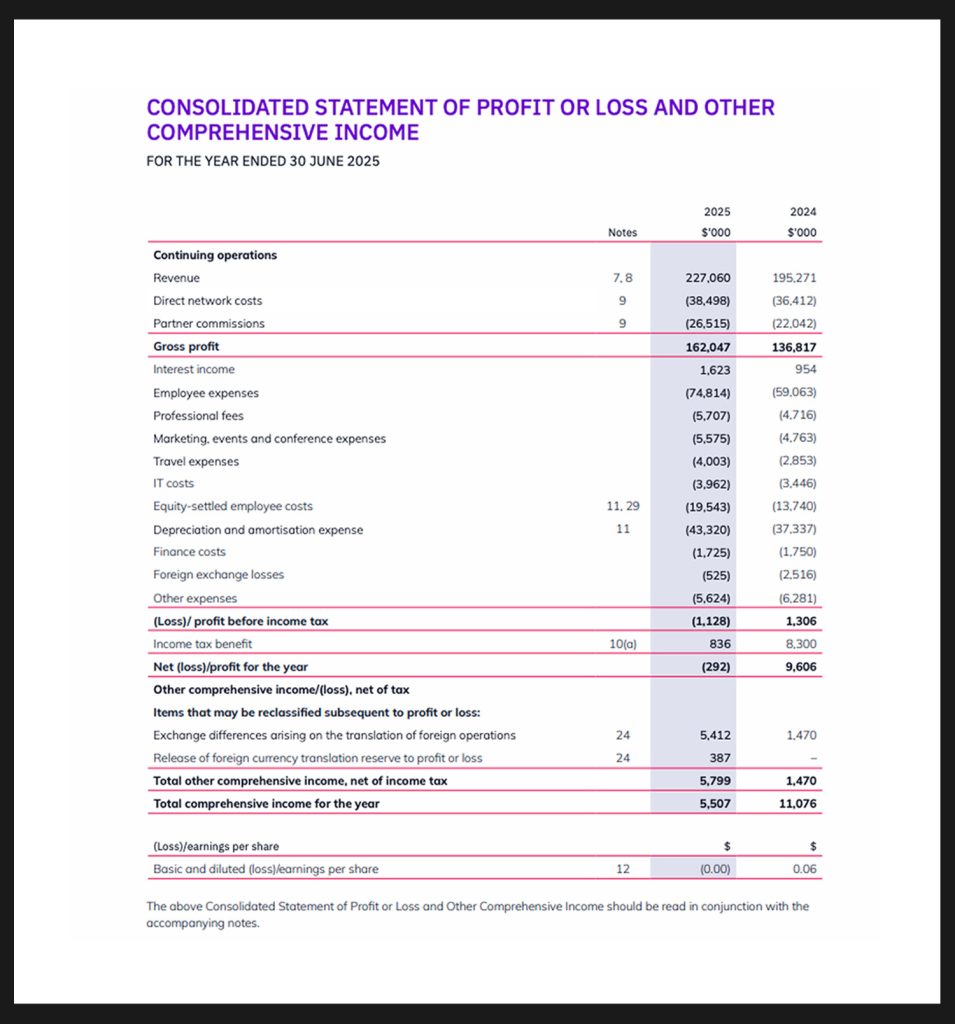

Australian publicly-listed data centre company Megaport has around 500 employees.

It runs a global network of service providers across over 1,000 data centre locations globally.

Its income statement is below.

Above: Megaport’s income statement provides few details about revenue sources, as it’s all derived from billing other businesses for data and network connectivity.

‘Cost of revenue’ lines include expenses related to running its network (power, space, network fees and maintenance) and paying commissions to its partnering data centre operators and other resellers.

The income statement reveals that employee payroll is one of Megaport’s main operating expenses.

It also lists ‘Equity-settled employee costs and related tax costs,’ which include costs of employee shares, restricted stock and deferred share plans issued.

Important!

Once all the operating expenses and tax are accounted for, the P&L indicates Megaport made a net loss for the year. It doesn’t specifically list an EBIT or EBITDA.

The final lines show how, by adding in unrealised gains from foreign currency translations, the company’s total comprehensive income for the year is in the black.

How Can The Income Statement Help You Grow The Business?

An income statement is one of the best ‘at-a-glance’ tools for managing your business:

- It helps SMB owners check that profitability is trending upwards, and make decisions about where to focus cost-efficiency efforts, based on real data. For example, if gross profit declines, you can dive deeper into materials costs or supplier deals.

- It helps external parties, like prospective investors, quickly get a feel for your profitability to give context to other aspects of your business proposal. A transparent P&L statement with a meaningful breakdown of key revenue streams and costs is vital to attract funding.

You can improve the viability of your business model by reviewing your income statement.

For instance, a high-level view of income streams can reveal ones that contribute most to overall revenue – and help you decide where to reinvest more heavily.

How To Analyse Your Income Statement.

Whether you manually build an income statement in a spreadsheet (here’s a template you can use) or generate the report via your accounting software, here are some tips:

- Compare against your performance in previous periods. You might review P&L for the last three financial years to look for trends in how revenues and expenses are changing. If you can separate the data by month, you may spot seasonal changes in profitability that can help inform advertising campaigns or guide resourcing.

- Weigh up your actual profitability against your budgets and sales forecasts. If you spent more than expected and didn’t hit your targets, you’ll need to rethink whether all of your expenses can be justified or whether your sales tactics and offers are on point. Do you have passive or recurring income streams or is it all high-touch?

Which Financial Reports Are Related To The Income Statement?

For true confidence in your small business’ health, you must get in the habit of reviewing these three interdependent reports together:

An income statement shows profitability over time, but you need to consider that in the context of your balance sheet and cash flow to see:

- Is your profitability leading to positive changes to your overall financial position (you own more than you owe)?

- Is money actually flowing in steadily and sustainably (so you can pay bills or manage unexpected costs)? Read more about liquidity ratios.

For instance, maybe you used profits from previous years to invest in new equipment for your business, steadily growing your assets (without adding to liabilities) on the balance sheet, which improves the net worth of your business.

(Related: Australian SMB’s Guide To Capital Expenditure).

How To Make Your P&L Statement More Effective.

How well you wield your bookkeeping tools can affect the value of your income statement as a source of useful insights about your SMB’s performance.

Opaque P&L reports are usually as a result of the profits and losses you record being poorly defined. For instance:

- If all income is simply categorised as ‘income’ in your chart of accounts, you’ll lack clarity about which kinds of products/services generated more income than others.

- If you don’t account for different categories of OpEx or the cost of revenue or cost of goods sold (COGS), it limits your ability to uncover which spending matters.

Depending on the complexity of your operation, your financial analysis could be hampered if you don’t construct a meaningful chart of accounts or set up accurate project and inventory tracking.

In other words, it’s smart to choose accounting tools that do what you need them to, and get professional advice if your income statement feels lacking in insight.

Jody